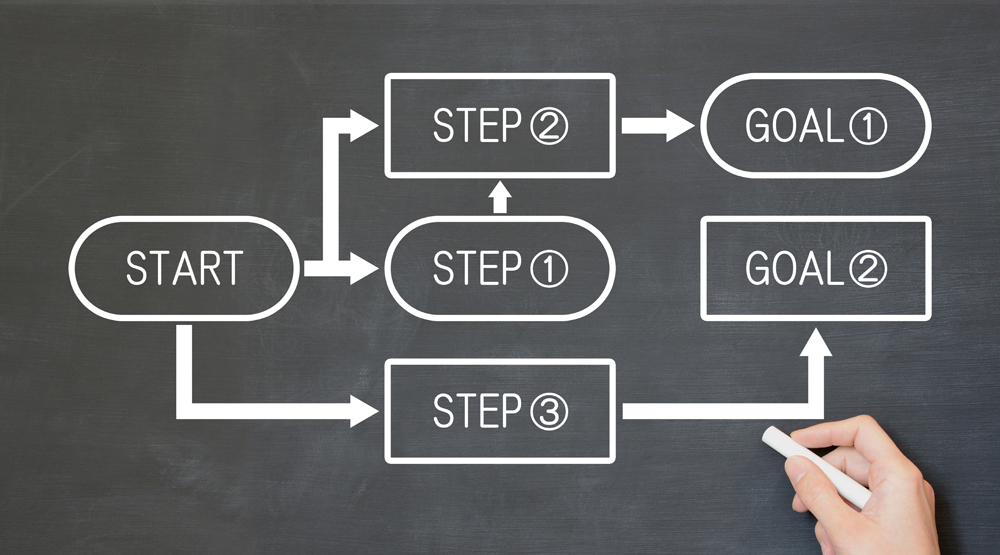

Schemes are important not only for overseas expansion but also for conducting business. We need a broader framework for doing business in a long-term and lasting way. This section introduces the scheme for overseas expansion.

目次

Understanding Schemes

You may have heard the word “”Scheme”” more often recently. Originally, a scheme meant “”plan with a framework””. The words plan and frame are sometimes used in the same sense.

Schemes are also used to describe mechanisms. In Britain, the word “”scheme”” has a meaning of “”public plan”” or “”plan””, which is considered to be the origin of the word “”scheme”” used in Japan. However, in American English, it sometimes means conspiracy, so you need to be careful.

For example, a franchise business is a business scheme in which franchisees provide know-how while paying a portion of sales as royalties.

What is the scheme for overseas expansion?

Overseas business schemes can take many forms. For example, there may be a case of establishing an overseas corporation with a 100% single investment. There are also cases of establishing joint ventures. What is important at this time is to select a scheme that is legal and possible in the countries where we are expanding overseas.

You may have heard the word “”foreign capital regulation””. Different countries have different schemes to choose from. For this reason, the key point is which scheme will make it easier to generate profits and enable us to continue our business over the long term.

The most problematic aspect of the business scheme is that it does not ensure sufficient profitability. To maintain profitability, HP recommends simulating the scheme with numbers. Flexibility is also important for future business development.

Complex schemes have many uncertain elements and can be difficult to convert to other businesses. We need a scheme that can be easily applied to any business in accordance with the profitability of the business. However, complex schemes, such as taking time and effort to develop cross-value, may be optimal when you can expect solid revenue.

What is Cross Value?

Going overseas with a single capital is simple and risky. However, there are also patterns in which it is difficult for 100% of capital to expand overseas due to restrictions on foreign investment and securing local profits. In such a case, a form called “”cross value”” is used in which businesses are run by multiple companies.

For example, if a Japanese manufacturer wants to expand its business overseas, it could establish a joint venture with a local company. Japanese companies provide manufacturing technology and know-how, while local companies provide know-how and management related to the operation of local factories. In such cases, the capital adequacy ratio is adjusted based on local laws, taking into account the investment ratio and costs. A manufacturing joint venture could be established with 51% Japanese and 49% local companies, and a sales joint venture could be established with 49% Japanese and 51% local companies.

As mentioned above, even between two companies, complex business schemes may be used to establish multiple joint ventures, and there may be business alliances between three or more companies. In these business schemes, conditions are determined based on simulations and then incorporated into contracts or the articles of incorporation of new companies. Such contracts are complex in nature and may be difficult to negotiate under laws and business practices different from those in Japan. You should also consider using consultants with expertise in overseas expansion.

What Are Foreign Capital Regulations?

Regulations on foreign companies are different from country to country. Foreign capital regulations are regulations when foreigners or foreign companies invest in domestic companies. For example, Thailand’s equity investment regulations require that the majority of shareholders be Thai. Therefore, if we don’t have a partner in Thailand, it will be impossible to do business in Thailand, and it will be difficult to expand into Thailand.

Also, whether a foreign company owns land or not depends on the country. In some countries, the area of land and real estate that foreigners and foreign companies can purchase is limited, so you need to be careful if you are planning to build a large-scale factory. In some countries, such as the Philippines, investment restrictions apply when you have multiple stores. In such cases, consider franchising your business and using a revenue-generating scheme.

There are also cases where control causes issues such as business mobility and management consistency. In that case, you could place the joint venture company under a management company established with a local partner. Depending on how the actual operation is carried out, the appropriate method also changes.

Summary

There are various schemes for overseas expansion. There is also a scheme to directly return profits to the head office in Japan, but depending on the regulations of the country where the company is operating, there may be a limited number of schemes to choose from.

Depending on the scheme selected, business development and potential risks may differ. Rather than being tied to a single scheme, let’s simulate each possible means.